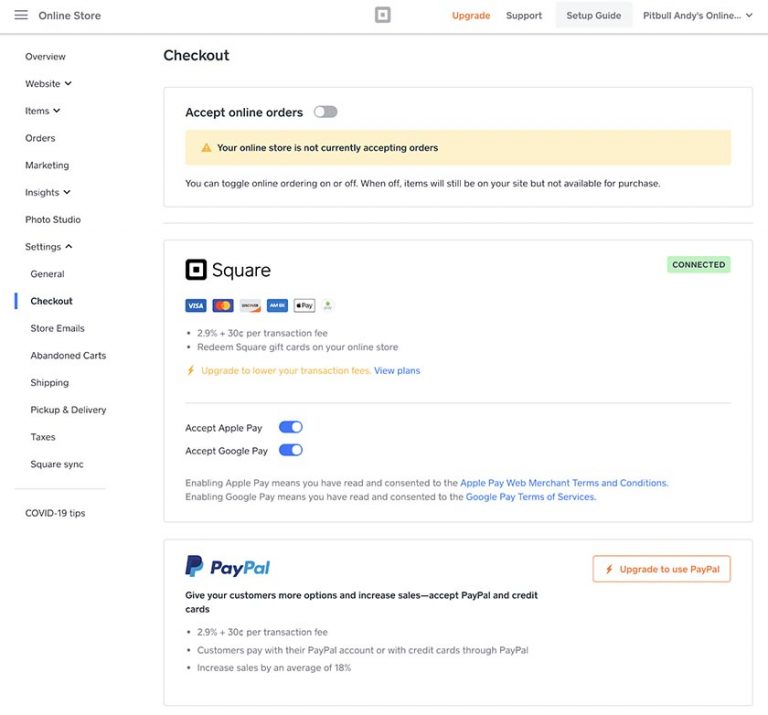

If you are a brick-and-mortar business, PayPal offers the lowest rate. We like the flexibility of PayPal’s modular offerings. The winner here comes down to how you plan to accept payments and what type of business you operate. Square allows you to accept all major credit cards, PayPal (only on the Premium plan), Apple Pay, Google Pay, and its proprietary digital wallet, Square Pay.

#Square vs paypal invoicing free#

Square provides free web hosting to new online stores.

#Square vs paypal invoicing code#

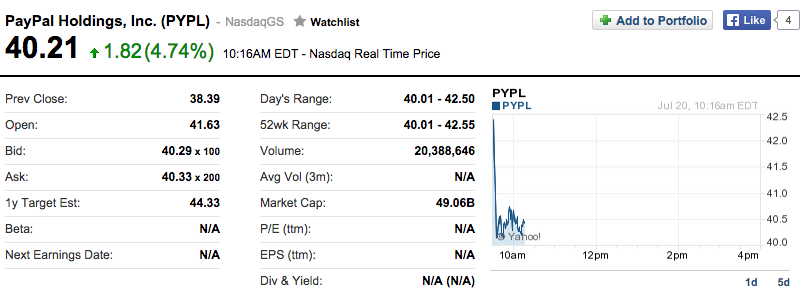

Sending customers invoices for one-time or recurring billingĬard present: 2.29% +$0.09 Keyed-in card numbers: 3.49% + $0.09 QR code under $10: 2.4% + $0.05 QR code over $10: 1.9% + $0.10 Payments by phone or mail, or in person if manually enteredĪccepting payments on the PayPal app, with a link on social media, or by sending a link with PayPal.Me Payments online (through your website, e-commerce platform and/or apps) PayPal has five major programs that you can mix and match according to your needs: Payment program Both accounts are free and easy to set up. To get that, you first need a personal PayPal account. Plans and pricing PayPal plans and pricingįor your business to accept payments via PayPal, you need to have a PayPal business account. In this section, we take a closer look at the services each provider offers and how they stack up against one another. Square is best for professionals and freelancers who have recurring billing, and restaurants and e-commerce businesses with in-house web developers. PayPal is best suited for brick-and-mortar retail businesses and nontechnical e-commerce businesses. Online checkout, virtual terminal, POS hardware, invoicing, Venmo Online checkout, virtual terminal, invoicing, POS hardware, Apple/Google Pay, Cash App, ACH Square mobile reader, Square Terminal, Square POS Register Over 350, including QuickBooks, Wix, and DoorDashīigCommerce, QuickBooks, Shopify, SalesVu, WooCommerce and more There are some distinctions, and which one you choose may depend on your industry and how you do most of your business. In addition, they both have suitable card processing hardware and integrations with multiple platforms.

PayPal and Square both provide merchants with an easy and convenient way to accept credit cards and other payment methods. We examined both of these services and evaluated them on various criteria, including pricing, processing services, software, hardware, integrations and security.Įditor’s note: Looking for the right credit card processor for your business? Fill out the below questionnaire to have our vendor partners contact you about your needs. To help in your research, we have made the comparisons for you. Two solutions you may want to take a closer look at are PayPal and Square. There are lots of options, so it is important to compare and contrast what’s out there.

In order to accept credit cards, you need to partner with a top credit card processor.

In today’s environment, only accepting cash and not accepting debit or credit cards won’t get you very far.

0 kommentar(er)

0 kommentar(er)